Little Known Facts About Offshore Business Registration.

Table of ContentsOffshore Business Registration - An OverviewLittle Known Questions About Offshore Business Registration.How Offshore Business Registration can Save You Time, Stress, and Money.Little Known Facts About Offshore Business Registration.

** This would refer to the corporate tax of the company, wherein the procedure of the firm would certainly take place outside the country of incorporation. *** The required documents must be offered for every specific associated to the business.Have an offshore firm prepared in an issue of days. 2 Submit Yourdocuments online 3 We sign up withauthorities abroad 4 Your firm and bankaccount are prepared!.

We make use of some essential cookies to make this internet site job (offshore business registration). We would love to establish additional cookies to recognize just how you utilize GOV.UK, remember your setups and improve federal government services. We also make use of cookies set by various other sites to aid us provide content from their solutions.

Developing yourself offshore has actually never been even more popular, as lots of people are seeking different resources and means to conserve cash, shield their privacy and properties in times of straightforward, simple and can be finished in a matter of days with simply a few fundamental personal details. This write-up is to take you through exactly how to establish an overseas business: from option, registration, completely to the development procedure in order to break the commonly held concept that a company development process is a troublesome affair with great deals of difficulties as well as discomfort in the process.

Offshore Business Registration Fundamentals Explained

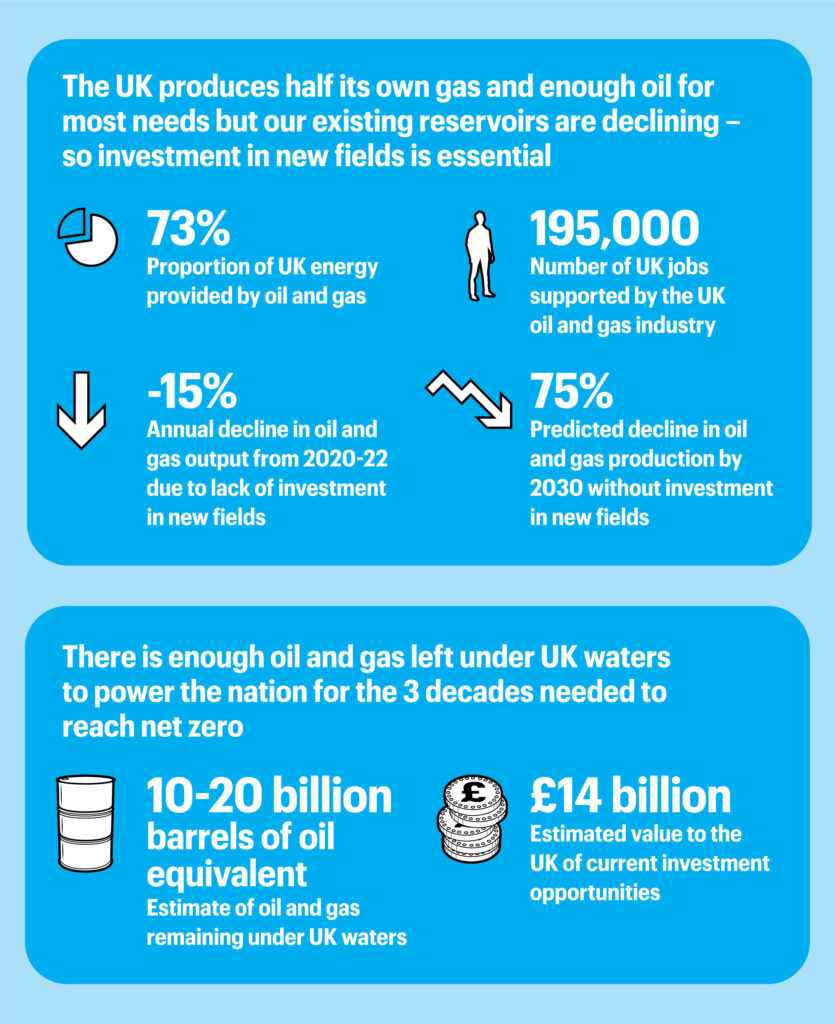

Depending upon your demands there are different overseas frameworks whether that is a Depend on, Foundation or IBC, LLC and so on. Due to the constantly transforming nature of the overseas industry, specifically when it pertains to overseas tax regulations, it is necessary to have up-to-date details, as local tax obligation regulations are increasingly altering due to international company pressures.

They are similarly vital to consider as numerous individuals like to maintain points close to residence - offshore business registration. The next set of concerns is most likely going to take some research study as tax obligation regulations are various for each and every nation. To see to it you are tax obligation compliant it is very important to talk to a qualified accounting professional or legal representative to make certain you are not missing out on anything.

While DTTs can help you conserve on taxes, CRS and also TIEA do not. are a kind of reciprocal tax obligation info you can try this out sharing that are authorized between member nations. While there are still many overseas territories that are not signatories the number is rapidly dwindling as even more and also a lot more nations are being co-opted by the OCED to sign onto higher openness steps.

Offshore Business Registration for Dummies

regulations regulate how corporations are dealt with as a tax entity. Every nation has its very own specific CFC regulations which might or might not affect your firm structuring. Some nations have extremely rigorous CFC laws that basically deal with foreign firms as regional entities for tax purposes. All of the above factors to consider are very important as they will influence the business structure, location as well as business vehicle that would certainly be made use of.

That is why it is so essential to speak with an overseas professional. Without such specialized understanding, there is the risk of creating the wrong entity in the wrong jurisdiction, with the wrong business structure. Developing a complete alternative offshore lawful strategy aids to ensure that all of the pieces are arranged and also that the overseas strategy fits with you the goals of the firm.

While that is not constantly the case, it is becoming a lot more common in position like Singapore, Panama, and also Hong Kong where there are more restrictions, greater cost and also more due persistance. Still, there are offshore territories like St Vincent, Nevis, or Andorra that do not require a regional firm and also can be opened basically without any kind of in-person demands.

Offshore Business Registration - An Overview

For this hyperlink people looking to maintain, making use of a 2nd LLC or IBC as a business supervisor as well as investor can be used to ensure that no person's identification continues to be on the business computer system registry. While a lot of offshore territories still have extremely stringent privacy and also financial privacy laws, like the Chef Islands, and Nevis, there are several countries like the United States and also several components of Europe that call for individuals to proclaim and also foreign ownership of a company, hence making your obligations to state any kind of business and also properties a commitment required by the country where you live.

As a result of the change in several countries' openness legislations foreign federal governments, if you stay in a nation that is a notary of the CRS then your government will certainly have greater access to your international corporation details. These records would just be offered to YOUR home federal useful source government, as well as would not be apart of the neighborhood public registry. offshore business registration.